S-Corp topics: S-Corp Year End Chores

|

S-Corp Tax Preparation Checklist

|

Organizers

Year End Chores for S-Corporations

- S-Corp returns must be filed by March 15. The late filing penalty with no extension is $260 per month, per shareholder. We will need your paperwork in Early February or we'll need to plan on filing an extension. Paperwork for your personal 1040 return can come later.

- Reimbursements: Reimburse shareholders and partners for personally paid travel, auto and other business expenses before Dec 31. You can also reimburse for prorated home office expenses if appropriate for your situation. All reimbursement arrangements should be documented. This is called an "accountable plan".

- Officer Reasonable Salary: A shareholder cannot take distributions (or "draws") from an S-Corp without first taking out a reasonable W-2 salary. This would typically be an amount comparable to the industry standard wages for similar work. Correcting low or nonexistent S-Corp owner payroll later can incur large penalties.

- Health Insurance for Shareholders: Health insurance paid (or reimbursed) by the company must be included as income on the shareholder's W-2, not subject to FICA taxes. You may need to catch up on these amounts in the final payroll run. Not reporting shareholder health insurance correctly is the most common S-Corp error I see. Scroll down for further information on correctly reporting this on the W-2.

- Closing the books: Certain year end entries must be made in Quickbooks to close out last year, and zero out some accounts for next year. This will be a matter for your bookkeeper. Scroll down for more details on closing the books.

If you and your bookkeeper have these year end chores squared away, you can start collecting your paperwork so we can prepare your annual tax return. We can directly access most client's Quickbooks accounts to download the reports we'll need to complete your tax return. If this is the case, you probably need to do nothing more than to ask your bookkeeper to do a year end reconcile and to let us know when everything is ready to go. Here is our S-Corp tax preparation checklist.

Close the Books

** The work in this section is intended for your bookkeeper. Please forward these instructions to that person. **

- Prior year asset depreciation is usually entered in April after the annual taxes are filed. It's good practice to check that this was not forgotten. The current depreciation data can be found in the depreciation schedule usually located toward the back of your prior year tax return. There's a video further down this page that will describe the two depreciation accounts and the entries to make.

- Clean up "Loans" that were really distributions. Ensure that true loans were documented with signed notes.

- Reconcile the bank and liability accounts and confirm books really match the bank.

- Prepare 1099-NEC and 1099-MISC for outside contractors paid more than $600 over the year.

Contact us by January 10 if you want us to create, mail and file these forms.

Year End Journal Entries for S-Corporations

- Close Distributions: Debit Retained Earnings (or Shareholders' Equity) and Credit Shareholder Distributions/Draws. This clears the temporary distribution account to zero for the new year.

- Close Net Income/Loss: Debit or Credit Income Summary and move the balance to Retained Earnings. (Some software, such as Quickbooks will do this automatically)

Handle Contributions: Unlike distributions, capital contributions (money invested) usually remain in the equity section, often under Additional Paid-In Capital, rather than closing to Retained Earnings.

- Timing: These entries are typically made on January 1, although software may vary on this. QuickBooks automatically closes Net Income to Retained Earnings on Dec 31, however manual journal entries to zero out equity accounts are generally dated Jan 1. You can confirm that you did this correctly if you change the date on your balance sheet report from 12/31 to 1/1. The December 31 report should show net income earnings and shareholder Distributions/Draws for only that year. Jan 1 will start fresh at Zero

- Video Guide These excellent short videos by Candus Kampfer will show the entries to make.

How to include S-Corp Shareholder Health Insurance on the W-2

S-corporations can provide health insurance as a tax-free benefit to their non-owner employees and deduct the cost as an insurance business expense. However, getting tax-free health insurance for S-corp owners isn’t treated the same way.

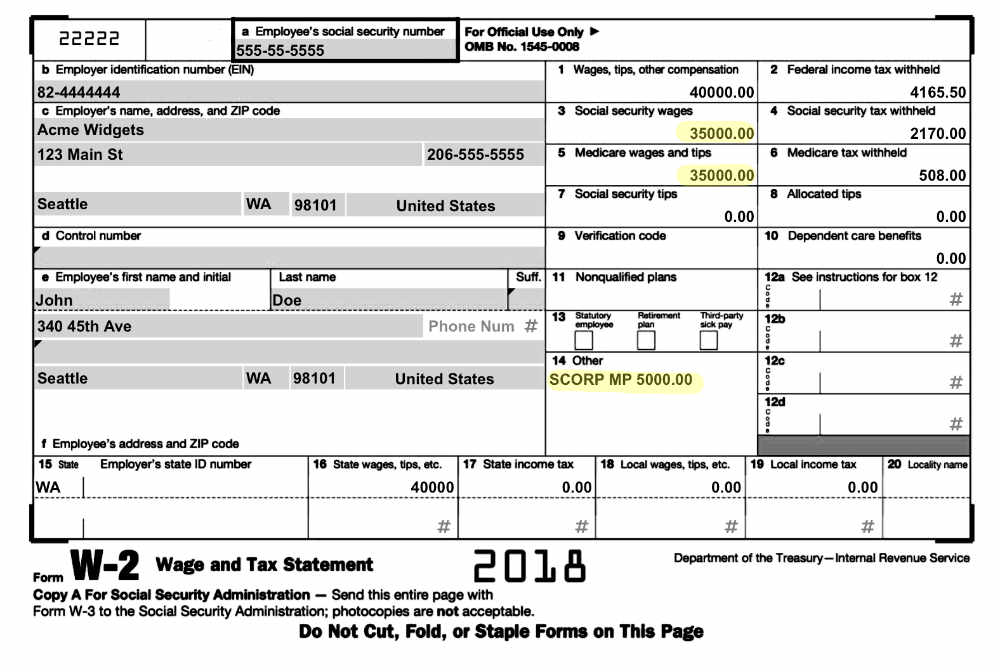

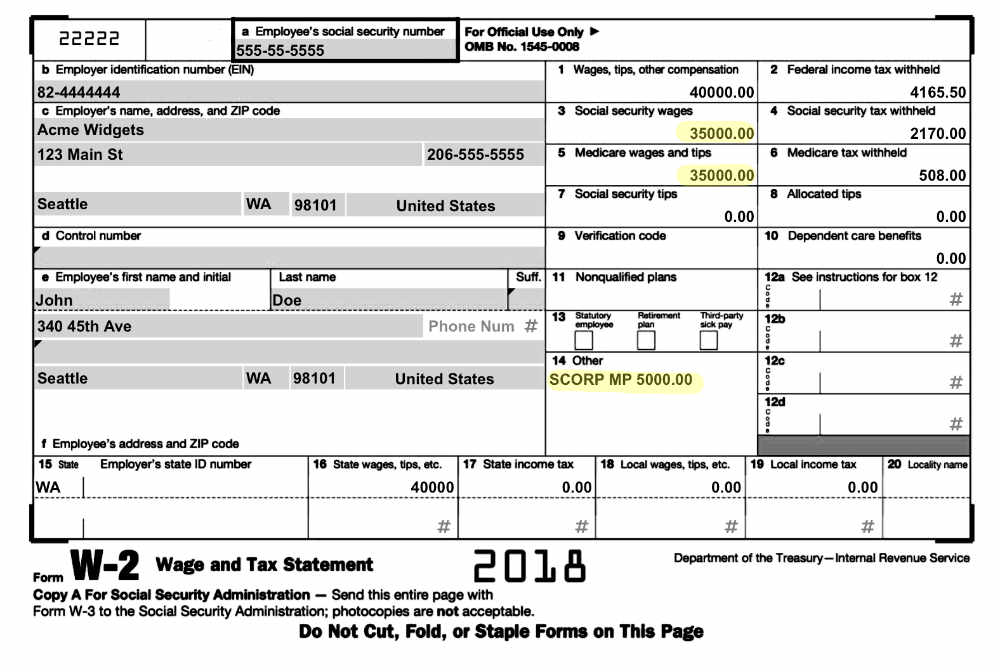

Health insurance premiums paid or reimbursed for shareholder-owners, their spouses, and their dependents must be added to W-2 wages. Importantly, these amounts are exempt from Social Security and Medicare withholding if the plan is also available to other employees in the same class. On the W-2, this additional compensation should be included in Box 1 (Wages) but excluded from Boxes 3 and 5. See the illustration below.

- This amount added to the shareholder's wages for insurance increases the wage expense of the company, which reduces net income. Be sure to reduce the corporation's "employee health" insurance expense by this amount so you don't double dip this expense.

- This amount can be deducted on the shareholder's personal 1040 to claim the valuable Self-Employed Heath Insurance Deduction.

- The shareholder cannot take the insurance deduction if they or their spouse works for another company that offers free or subsidized health insurance, whether or not they choose to take it. There are other qualifications to taking this deduction, so it's best to check.

Bookkeepers: Note the reduction in Social Security and Medicare wages to

match the $5000 Health Insurance expenditure on behalf of the shareholder. There is also a notation in box 14.

See the links below to see how to set this up in Quickbooks.

Reimbursing the Shareholder if they personally paid for the insurance or has Medicare

If a qualifying shareholder purchases a policy in their own name and pays the premiums personally, the S-Corp must reimburse them and include those amounts in their wages. In this case, the company is considered to have made the payments directly and may take the expense. This applies to all parts of Medicare, ACA Marketplace insurance, and coverage for spouses and dependents.

All reimbursements should be processed before the end of the year.

Working with ACA Health Insurance for an an S-Corp 2% Shareholder (Obamacare)

It is recommended that the company pays ACA health insurance premiums directly. Since these plans are typically subsidized by a Premium Tax Credit (PTC), the credit is reconciled on the shareholder's personal tax return at year-end. This results in either an additional refund or an additional tax liability depending on whether the PTC taken was insufficient or excessive.

For S-Corp shareholders, an excessive PTC situation is particularly complicated because premiums must be included on the W-2. Without amending the W-2, it may not be possible to claim the full health insurance deduction. To avoid these complications, it is advisable for shareholders to err on the side of taking a lower PTC and paying a slightly higher premium.

Links / References

Closing Entries

Overview of closing entries from Quickbooks

Cliff Notes on bookkeeping closing entries

Bookkeeping Closing Entries

Medical Insurance on the W-2

Quickbooks: How to set up S-corporation medical payroll items

Gusto 2% Shareholder Benefits (second to last dropbown)

Quickbooks: Apply S Corp Medical at year end for corporate officers

This article is a simplification of the rules. Please refer to IRS Notice 2008-1 or call us for full details.